what is suta tax california

5 of 7000 350. FICA tax is a 62 Social Security tax and 145 Medicare tax on earnings.

The new employer SUI tax rate remains at 34 for 2020.

. SUTA dumping is also referred to as state unemployment tax avoidance and tax rate manipulation. 20 rows What is SUTA. You will pay 1050 in SUI.

SUTA State Unemployment Tax Act dumping one of the biggest issues facing the Unemployment Insurance UI program is a tax evasion scheme where shell companies are formed and creatively manipulated to obtain low UI tax rates. See Determining Unemployment Tax Coverage. California uses the Dynamex ABC Test to determine whether a worker is an employee for purposes of unemployment tax coverage.

350 x 3 1050. For example the SUTA tax rates in Texas range from 031 631 in 2022. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays.

The UI rate schedule and amount of taxable wages are determined annually. Timeline for receiving unemployment tax number. In California in recent years it has been somewhere around 34.

The state unemployment tax also called the state payroll tax or simply SUTA is a payroll tax you pay into your states unemployment benefits fund. Using the formula below you would be required to pay 1458 into your states unemployment fund. FUTA or Federal Unemployment Tax is a similar tax thats also paid by all employersHowever the money collected from the FUTA tax funds the federal governments oversight of each states individual unemployment insurance program.

Is There A Way To Find My Unemployment Id Number I. We notify employers of their new rate each December. New employers pay 34 percent 034 for a period of two to three years.

What is the SUTA tax. All UI taxes for 2022 have been paid in full by January 31 2023. UI is paid by the employer.

Assume that your company receives a good assessment and your SUTA tax rate for 2019 is 27. 52 rows SUTA Tax Rates and Wage Base Limit. As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers.

Most states send employers a new SUTA tax rate each year. The California Employment Development Department has confirmed that unemployment tax rates are unchanged for 2022 on its website. Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage base.

Each state has its own SUTA. For example the wage base limit in California is 7000. The new employer SUI tax rate remains at 34 for 2021.

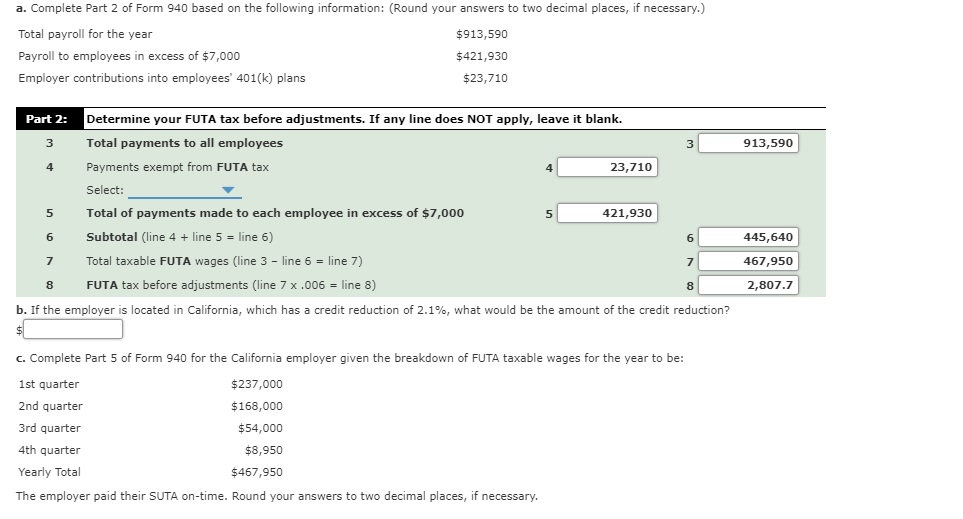

What is FUTA. California law defines wages for state unemployment insurance SUI purposes as all compensation paid for an employees personal services whether paid by check or cash or the. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

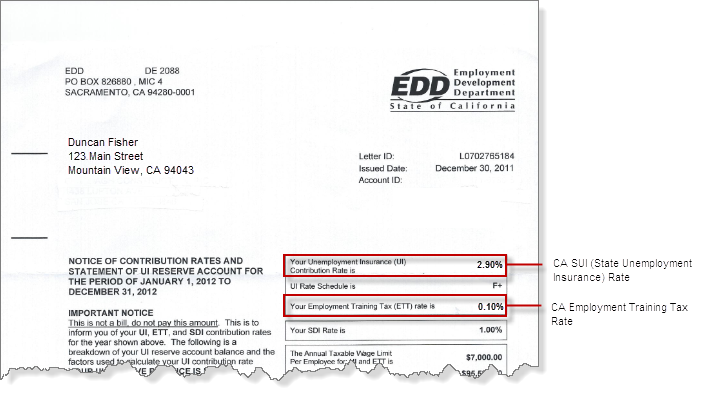

The ETT rate for 2022 is 01 percent. The maximum amount of taxable wages per employee per calendar year is set by statute and is currently. How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor.

In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. The state typically issues a SUTA tax number within 10 14 days unless its during a peak end-of-quarter season. Generally states have a range of unemployment tax rates for established employers.

Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees. Register immediately after employing a worker. Here is how to do your calculation.

Up to 25 cash back The state UI tax rate for new employers known in some states and federally as the standard beginning tax rate also can change from one year to the next. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. A new employers rate usually will remain the same for at least the first two or three years.

SUTA is a tax paid by employers at the state level to fund their states unemployment insurance. Employer registration requirement s. The SUI taxable wage base for 2021 remains at 7000 per employee.

Once you know these you can do the calculation. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

350 x 3 1050. When a low rate is obtained payroll from another entity with a high UI tax rate is shifted to the account with the. Alaska Department of Labor.

Your state will assign you a rate within this range. If one of your employees ever gets laid off and starts collecting state unemployment insurance its likely that money will come from your states State Unemployment Tax Act fund. 5 of 7000 350.

Tax-rated employers pay a percentage on the first 7000 in wages paid to each employee in a calendar year. What is the state payroll tax in California. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays.

A Complete Guide To California Payroll Taxes Rjs Law

What Is Sui State Unemployment Insurance Tax Ask Gusto

1.jpg)

Ca Sdi Deduction Das Drake Accounting How Do I Set Up The Ca Sdi Deduction Summary Of California State Disability Insurance Sdi Setup Confirm That Your Client S State Is Ca Set The Appropriate Ca Rates And Limits For Unemployment And Disability

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

How To Update Suta And Ett Rates For California Edd In Quickbooks Desktop Youtube

The True Cost Of Hiring An Employee In California Hiring True Cost California

2.jpg)

Ca Sdi Deduction Das Drake Accounting How Do I Set Up The Ca Sdi Deduction Summary Of California State Disability Insurance Sdi Setup Confirm That Your Client S State Is Ca Set The Appropriate Ca Rates And Limits For Unemployment And Disability

I Know This Looks A Bit Lengthy But I Could Really Chegg Com

A Complete Guide To California Payroll Taxes Rjs Law

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

How To Update Suta And Ett Rates For California Edd In Qbo Youtube

Payroll Taxes Cost Of Hiring An Hourly Worker In California In 2020

Update Suta And Ett Tax For Quickbooks Online Candus Kampfer

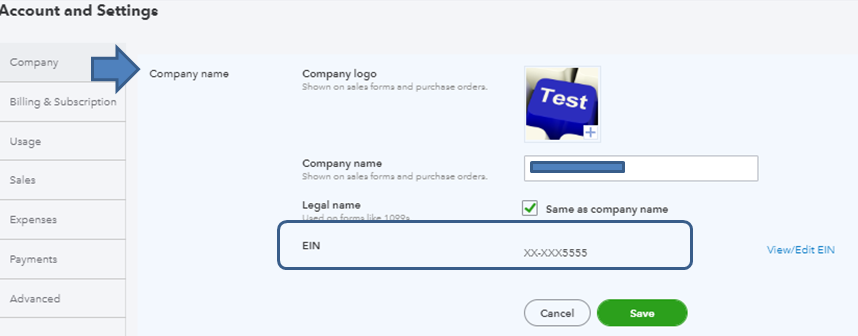

How Do I Get My California Employer Account Number

Make Your Tax Deposits On Time

4.jpg)

Ca Sdi Deduction Das Drake Accounting How Do I Set Up The Ca Sdi Deduction Summary Of California State Disability Insurance Sdi Setup Confirm That Your Client S State Is Ca Set The Appropriate Ca Rates And Limits For Unemployment And Disability